Measures of Leverage

Content

To calculate it, take the EBIT (earnings before interest and taxes) and divide it by the interest expense of long-term debt. Only people who borrowed for investment, such as speculative house purchases or buying stocks, were using leverage in the real financial sense. Operating leverage can also be used to magnify cash flows and returns, and can be attained through increasing revenues or profit margins. Both methods are accompanied by risk, such as insolvency, but can be very beneficial to a business.

Here are some examples of what financial leverage ratios can look like in practice. What is considered a high leverage ratio will depend on what ratio you are measuring. For example, a total debt-to-assets ratio greater than 1 would be considered high – meaning a company has more liabilities than assets. An ideal financial leverage ratio varies by the type of ratio you’re referencing.

What is a good financial leverage ratio?

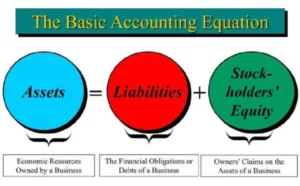

Instead of looking at what the company owns, it can measure leverage by looking strictly at how assets have been financed. The debt-to-equity (D/E) ratio is used to compare what the company has borrowed compared to what it has raised from private investors or shareholders. A company can analyze its leverage by seeing what percent of its assets have been purchased using debt. A company can subtract the total debt-to-total-assets ratio by 1 to find the equity-to-assets ratio. If the debt-to-assets ratio is high, a company has relied on leverage to finance its assets.

A lower financial leverage ratio is usually a mark of a financially responsible business with a steady revenue stream. For many businesses, borrowing money can be more advantageous than using equity or selling assets to finance transactions. When a business uses leverage—by issuing bonds or taking out loans—there’s no need to give up ownership stakes in the company, as there is when a company takes on new investors or issues more stock. Leverage is nothing more or less than using borrowed money to invest. Leverage can be used to help finance anything from a home purchase to stock market speculation.

More meanings of leverage

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. If the home’s value increases 10% to $550,000, your gains would be magnified to 50%. That’s because an increase of what is financial leverage $50,000 is only 10% of the home’s value, but is a 50% increase on your investment of $100,000. Increasing leverage through issuing more debt is an alternative to issuing equity. Whether you want more money and free time (or just less stress!) leveraging can be a useful tool.

Leverage can be a great way for a company on the rise to shoot to the top. By carefully leveraging stock assets, keeping variable costs low, and knowing one’s debt-to-income ratio, a company can succeed like never before. Leverage is borrowing funds from a third party against a company’s assets. This allows a profitable company to put more money behind its rising stocks.

Leverage

If they had any other liabilities listed, those would need to be included as well. Going with Option A would have provided Joe with a profit of $30,000; a 12% return on his initial investment. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.